Traditional insurance can be a little old-fashioned. You probably have this image of piles of documents with loads of questions and frequent meetings with insurance brokers in dreary suits. It can be really tedious to fill out 10 pages of insurance applications every year and approval can take long. Getting professional indemnity insurance and public liability insurance cover in place quickly is an uphill struggle.

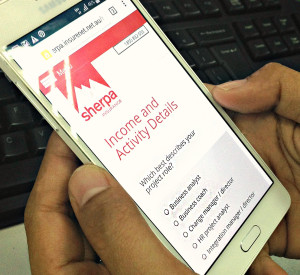

Things are different in this age and time where professionals are consistently on the move. Finally, insurance gets a digital makeover. The task of getting insurance covers has become easier, smarter and more socially savvy. Particularly for contracting management consultants and project professionals.

Faster, smarter purchase process

Smarter management consultants, project managers, business analysts, change managers and test managers have a lot to benefit from the digitisation in the insurance market. Comparison of insurance products has become easier as online platforms promote transparency of price as well as product details.

Application and getting a cover may take less than a few clicks—the same amount of time (and effort) it takes shopping online. What starts in bytes ends in bytes, as they say.

Digital is Human

Digitisation has changed customer interaction as well. Online insurance providers are now more capable of building relationships with customers. Through social media, insurance providers are engaging customers in meaningful conversations across different social channels. This allows them to be more personalised in offering their services.

Have online and social platforms helped you in your recent business transactions? Please share your stories with us.