As you may have seen in earlier blogs, Sherpa Insurance conducted focus interviews during late 2014 and early 2015. The interviewees were management consultants, project managers, change managers, test managers and business analysts. What they all had in common was they worked in Australian and were independent contractors.

The consistent gripe was without hesitation – no one liked paying for business insurances such as professional indemnity or public liability. All stated with differing various levels of passion. The consensus was that proving proof to your client that current business insurance is in place is a necessary part of business, as opposed to needing protection in the case of a claim. (NB: this writer has the identical issue and requirement under the Australian Financial Services Licence….)

After getting that one off their chests, the second gripe was “why do I need to fill out the same 8 or so pages of insurance application form….every year.” Nothing more needs to be said here.

To summarise the interviewees:

- I don’t like paying for it, so make it cost effective for me.

- I don’t like spending time on it, so make it fast and instant so I can forget it for another 12 months.

- I don’t like all the forms, so make it easy for me and keep all my details for next year.

To keep premium costs low, transacting online is a prerequisite to “make it cost effective for me”.

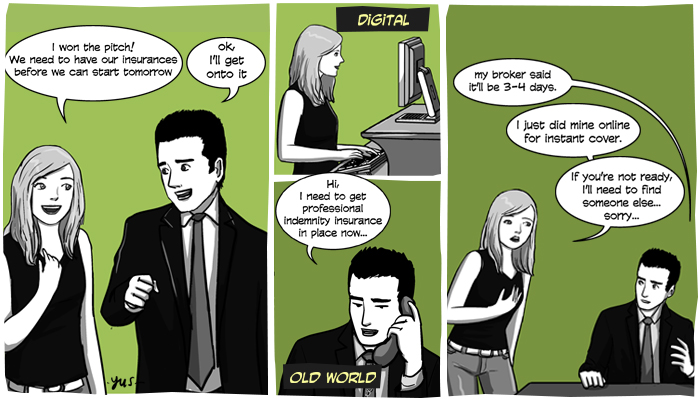

Providing instant cover is the knockout blow for “make it fast for me”. This translates to a short and targeted application and receiving all your insurance documentation the moment you buy. The current market norm is receiving documentation after four days.

Customers want and need to be able to buy outside normal office hours. So for “make it easy for me” this means being able to apply for cover 24/7. Coupled with using straightforward language and retaining application information for the future.

“Make it cost effective for me”, “make it fast for me” and “make it easy for me”, none of this can be done without digital.

Andrew Bremner is the founder and Managing Director of Sherpa Insurance who specialises in providing online Professional Indemnity Insurance.