So you’ve drawn up a list of New Year’s resolution and this includes a new weight loss regimen and a new work routine. “Out with the old, in with the new” – we keep to this age-old mantra year after year after year.

This is also the perfect time to review your business risks.

The start of the year is an opportunity to risk health check you business – starting top down. It begins with an embarrassingly simple question that unlocks the answers –

What are the risks facing our business?

Imagination prompters may include customers, competition, suppliers, regulation, employees, environment, state of the economy (local, regional and global).

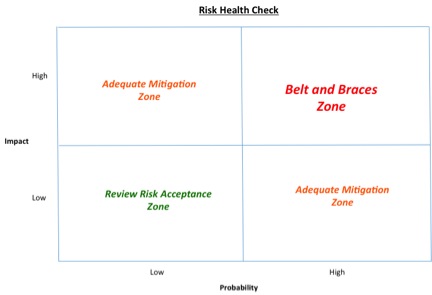

Plot the risks on the risk impact and mitigation McKinsey 2 by 2 matrix. For HIGH-HIGH, you need bullet proof mitigations. For LOW-HIGH and HIGH-LOW you need adequate mitigations. The remaining LOW-LOW may require

mitigation or business acceptance. Then replot the risks after mitigation and review.

No, this is absolutely not rocket science and many of you will have already used this approach for project reviews, business acquisition and more.

You’re probably thinking – “hey I do this constantly”… but there is a clever and also a surprising part.

The clever part is doing this regularly (annually at least) and also formally with senior team members. Then documenting the results both risk and mitigation, and implementing a plan to get the mitigations in place.

The surprising part is that risk mitigation may not include insurance. In fact often insurance is a last resort once everything else has turned to custard. It is not to say you don’t need insurance, rather it reframes the insurance discussion…. rather than “so what level of statutory liability cover do we need this year?” It becomes, “Does the business face any statutory risks and where on the matrix do they fall?”

In our own insurance business, we regularly facilitate risk health checks with our customers. The feedback is almost always strongly positive. And here are some examples.

“That was soooo useful! I now understand what Mary from Sales was concerned about” or,

“That was great! We now have a common understanding and vocabulary on our risks and mitigations across the management team” and

“Thank goodness we have addressed that risk. Otherwise we would be in real trouble this year”.

Roll on 2016!