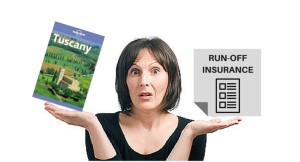

So as a project professional or management consultant you’ve worked darn hard for some years. Now you have decided to have a real break – sail around Australia maybe live in a village in Tuscany, a desert island or spend some years following the snow. Ah, the bliss…

Sorry to spoil the dream but there’s a catch.

The clients you dealt with over all those years still have up to 6 years to bring legal action against you under professional indemnity. Fortunately there is a simple and cost effective solution – it’s called run-off insurance cover.

Australian States and Territories in have their own statute of limitations requirements. For New South Wales, most personal injury claims it is 3 years and 6 years for non-personal injury claims (i.e. Financial claims such as under Professional Indemnity). So if you do any Government work, most contracts require you to maintain the PI cover for 6 years.

Professional indemnity (PI) insurance operates on a ‘claims made’ basis. In other words, the liability for a PI insurer to pay a claim made against an agent is crystallised at the time a claim is made (or when an insurer is notified of circumstances that may give rise to a claim). This is as opposed to when the incident actually happened.

Some insurers provide run-off cover and it’s normally not too expensive – say 20% of a standard premium. However there is plenty of industry variation so it’s worth looking around. At Sherpa Insurance we also offer run-off cover.

If it is important to you or a requirement to remain protected, get ‘run-off’ cover in place before you head toward that desert island.

Leave a Reply